Bank reconciliation

We have two types of transactions on a bank account

- IN, money sent from customers, credit notes etc.

- OUT, payment to suppliers, loan repayment etc.

At the start of an accounting period, for example the start of January, the bank account will have a certain amount of money, the starting balance / inngaende saldo. When all transactions for january is accounted for, it will have an ending balance / ny saldo. One can think of this in terms of input and output. For each month there will be an input amount for this month, and an output which is input to the next month.

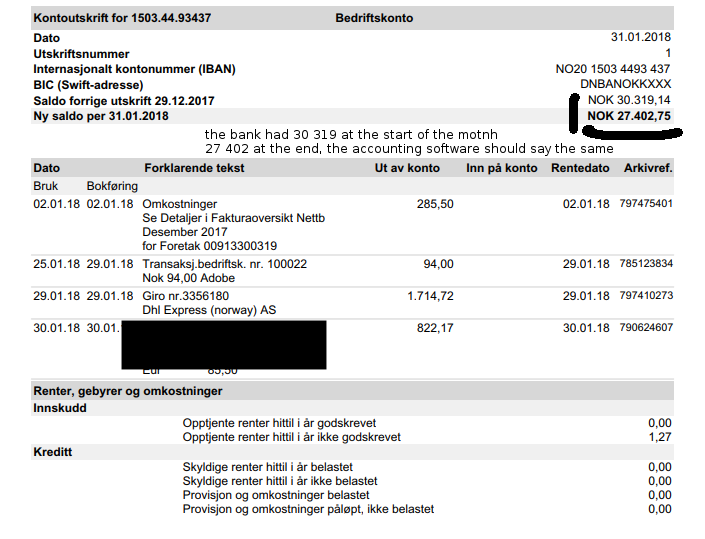

A simple bank statement / kontoutskrift can be seen below:

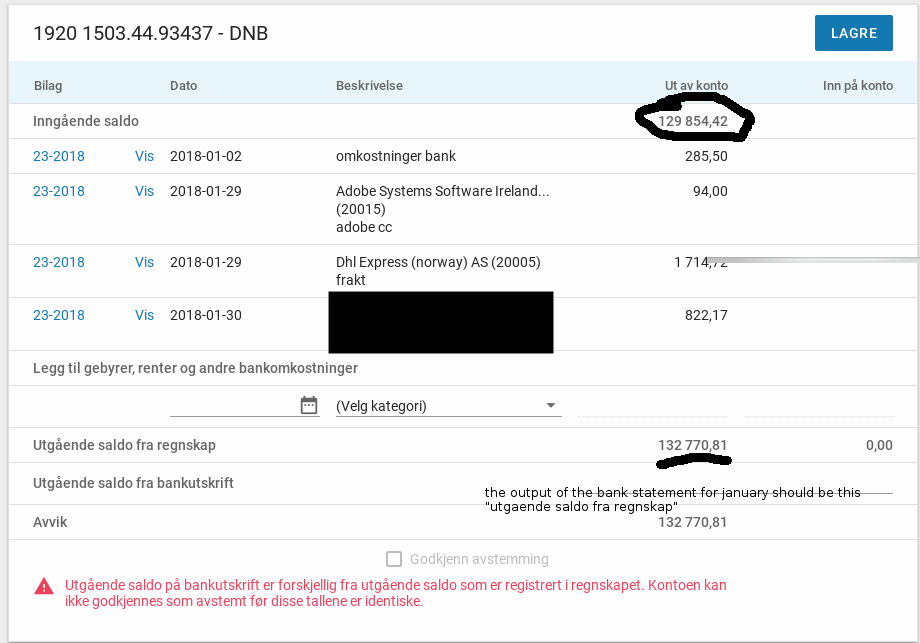

The goal in doing bank reconciliation is to ensure that the bank statement corresponds to what has been recorded in the acounting statement. Things to look for:

- The input is wrong

- The output is wrong

input is wrong

The input is the output of the previous months, so this tells us that we have to go back in time, and find missing or wrong records for the previous month OR months longer back in time, back to the start of accounting and the first opening balance.

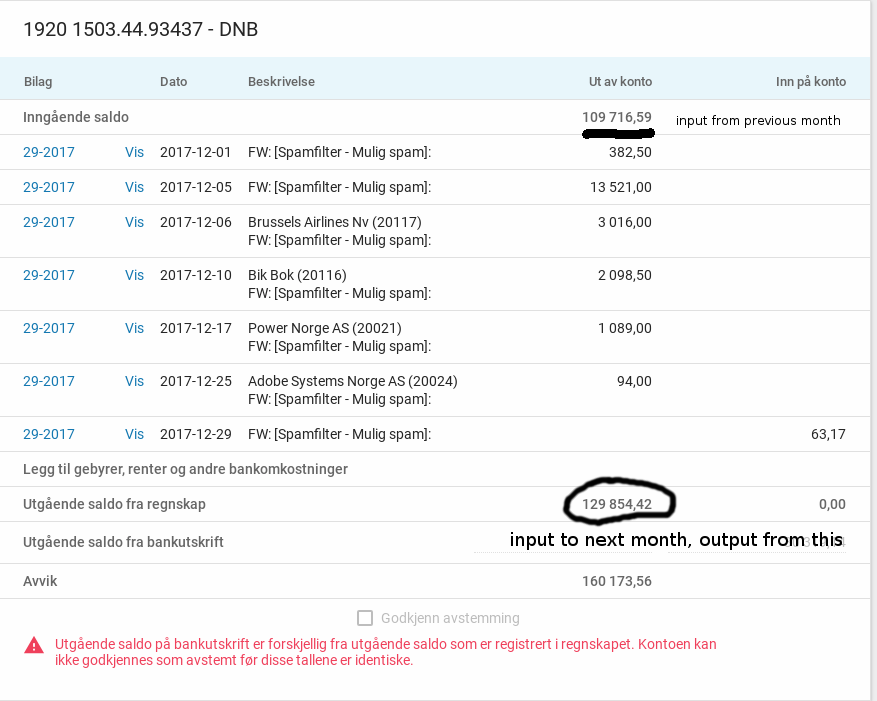

An example can be seen from the next images, which is the accounting software’s recording of the bank statement above and a previous statement. What the accounting software has recorded for previous months is obviously wrong, as the input for the next month is too high.

The reason for this particular case is probably that transactions were recorded on this account, which really was another account, since we was in the transition of changing to another account in this period.

The output is wrong

This one is easier, you probably miss an invoice from a supplier if the output is more than the bank statement output.

If the output is less than it should, then you miss customer payments. Maybe you forgot to record the payments from

Stripe or Paypal.